Labour Chancellor Rachel Reeves’ 2024 Autumn Budget has had strong reactions from the farming community, particularly over inheritance tax adjustments that could greatly affect family-owned farms. The blog explores what this means for both farming and non-farming communities.

The changes introduced for British agriculture were announced on 30th October 2024 include:

- Inheritance Tax: New caps on Agricultural Property Relief (APR) may increase inheritance tax on family farms, potentially forcing land sales to cover costs.

- Cost Increases: Higher National Insurance rates and changes in business rates are likely to increase operational costs for rural businesses.

- Sustainability Initiatives: There’s support for eco-friendly practices, including incentives for sustainable land management, but the APR cap could reduce these benefits.

- Infrastructure Resilience: Funding has been allocated for rural resilience, like flood defences, yet effectiveness will depend on consistent government support.

Other changes include an accelerated reduction in direct payments, set to reach a 100% cut for larger amounts by next year, which could tighten financial margins for many small and medium-sized farms. This may encourage farmers to explore alternative income streams or reduce investments in sustainable farming practices due to limited cash flow.

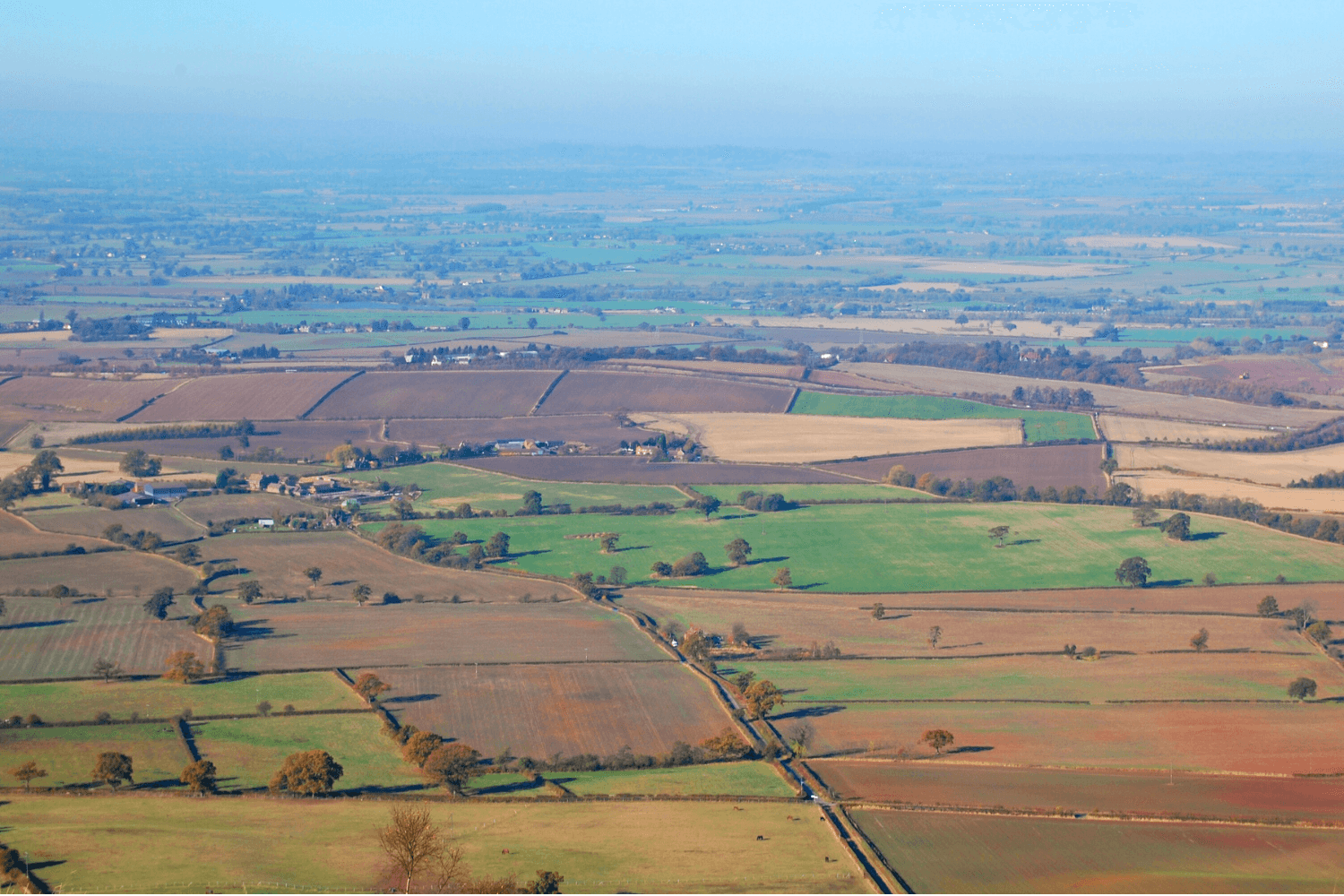

The new APR limitations may lead some family-owned farms to sell land to meet tax requirements, potentially disrupting the continuity of generational farms that contribute to local economies, food security and environmental stewardship through sustainable land practices. For rural economies, these changes may mean fewer small and family-run farms, with therefore ripple effects on local supply chains and rural employment.

It seems that the main problem for Farmers regarding these new changes, is that Tax must be paid in money, but the tax isn’t on money, the tax is on land. It’s commonly known that Farmers are asset rich but cash poor, so many are worried about the future of their businesses from these new changes.

Watch a panel discussion on BBC Newsnight recorded 13th November 2024, from 11 minutes 54 seconds onwards, with Rebecca Wilson 5th generation farmer in Yorkshire, Alex Sobel Labour MP for Central Leeds & Headingly, Emily Sheffield Journalist fat the Evening Standard

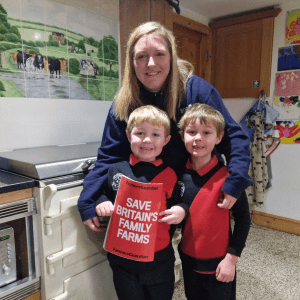

We asked Milly Fyfe, Farmer and Founder of No Fuss Meals For Busy Parents, what these changes mean for her business:

“As a Northamptonshire farmer, mother, and social entrepreneur, the changes announced in the 2024 Autumn Budget are deeply troubling for family farms like ours. While I appreciate the intention behind the government’s policies to address wealth inequalities, the approach to inheritance tax reforms is misguided and risks devastating repercussions for British agriculture.

The cap on Agricultural Property Relief (APR) means that many family farms, including ours, could be forced to sell off land just to meet tax obligations when passing the farm to the next generation. This “one-size-fits-all” policy fails to consider that farmers are often asset-rich but cash-poor. For us, the land isn’t just an asset; it’s the cornerstone of our livelihood and the foundation of our community.

Ironically, the land we may have to sell could end up in the hands of the very ‘mega-rich’ the government aims to target, further concentrating land ownership and reducing opportunities for families like ours to continue farming sustainably. This is not just an economic loss but a cultural one, as generational family farms embody stewardship, community identity, and food security.

Beyond the inheritance tax changes, rising operational costs and an accelerated reduction in direct payments will strain already thin margins. This makes it harder for us to invest in sustainable practices or innovative diversification, despite government incentives in these areas. The disconnect between policy intentions and real-world impacts is stark.

I recently spoke on BBC Politics East to urge the Labour government to reconsider its policies, emphasising the critical role family farms play in producing British food, supporting rural economies, and preserving our natural environment. Without meaningful consultation and tailored solutions, these policies threaten to dismantle the very fabric of rural life.

We need the government to understand that British farming is not a monolith. Family farms are small businesses, often just scraping by despite their significant assets. These reforms risk hollowing out the industry, with lasting consequences for our countryside and food supply.”

Why did Farmers have Inheritance Tax Relief?

Farmers historically had inheritance tax relief through Agricultural Property Relief (APR) and Business Property Relief (BPR). These reliefs were designed to support continuity in farming businesses by reducing the tax burden when farmland, buildings or other assets were passed down to the next generation.

Farming often requires large investments in land and equipment, which can be hard to liquidate for taxes, so these reliefs have helped ensure farms stay within families and continue operating instead of being sold off to pay inheritance taxes.

Many family farms have multiple generations because they all see themselves as custodians of the land. They want to continue to look after it, so it continues to provide the population with food, whilst conserving wildlife and benefiting the environment.

When these changes were announced National Farmers Union (NFU) President Tom Bradshaw said:

“This Budget not only threatens family farms but will also make producing food more expensive.

“The shameless breaking of those promises on Agricultural Property Relief will snatch away much of the next generation’s ability to carry on producing British food, plan for the future and shepherd the environment.

“It’s clear the government does not understand that family farms are not only small farms, and that just because a farm is a valuable asset it doesn’t mean those who work it are wealthy.”

In summary, these were unexpected changes that were opposite to what Labour promised to the Farming community, leading up to the general election this year. The farming community have asked to be consulted before the final decision on these changes in the Budget are to be made. There was an independent Farmers rally in Westminster, London on November 19th 2024.

Resources:

Government website: News story on What are the changes to agricultural property relief?

BBC News article: How many farms will be affected by Budget tax rises?

National Farmers Union (NFU website): Budget blow for British farming, says NFU

Farmers Guardian article: NFU’s Tom Bradshaw says Government must realise ‘human impact’ of Budget